An introduction to Anthony Phillips, Realtor at Luxury Real Estate Advisors Las Vegas, who is counterpointing claims asserted by the top US legal firms to prevent detrimental changes that may impact future Veteran and FHA borrowers.

(Disclosure, Mr. Phillips does not speak for any of the named Defendants, nor given permission to publish opinions.)

It appears that Plaintiff and Plaintiff’s Counsel’s goal is to force Buyers to pay Buyer Agents direct (out of pocket) vs. the Buyer absorbing fees into a mortgage. Claims assert that the Seller is harmed when a Selling Agent shares their commission with a Buyer’s Agent. This is not an adversarial transaction, all parties have the same goal, and the Seller has committed to paying a fee to accomplish their NET PROCEEDS goals. Seller’s Agents partnering with Buyer’s Agents benefit the Seller in achieving their net proceeds goal.

A Plaintiff corroborates our opinion that real estate transactions are non-adversarial in a similar lawsuit, Moehrl vs. NAR, Case: 1:19-cv-01610.

Plaintiff Christopher Moehrl entered into a listing agreement and Buyer representation agreement with his broker on the same day because he expected he would be purchasing and selling in close proximity to one another. In those two transactions, Mr. Moehrl paid $10,530 in Buyer-broker commissions on his home sale but avoided $17,550 in Buyer-broker commissions on his home purchases. Furthermore, it appears that the Seller provided a credit of $2,500 to Moehrl.

Moehrl suffered no harm and benefitted from the existing framework to transact.

Claims that transactions are “adversarial” fail.

Loan Program Implications

Per the VA: “Fees or commissions charged by a real estate agent or broker in connection with a VA loan may not be charged to or paid by the veteran-purchaser.”

Suppose Buyers must pay their agent directly out of pocket up front vs. absorbing fees into a mortgage. This may eliminate the VA Loan program and drastically increases fees for Consumers seeking FHA loans, comprising ~20% of loan originations.

The impact will disproportionately harm low-income Buyers.

I do not assume that the intent is to diminish the path to homeownership for millions of US citizens, including Seal Team Six; however, the collateral damage from this case could cause this event. The real estate market could crash, harming the same Sellers seeking relief.

The benefits of the current framework to US citizens and the broader commercial markets; FAR exceeds any damages to a subsection; thus, the status quo is permissible per anti-trust statutes.

Additionally, the Seller is not required to accept an offer. Net proceeds are the only metric that matters, and Sellers can counter $5,000+ to offset any fees they believe are unjust.

As depicted in the Moehrl transactions, those same Sellers subsequently benefited from this invented “scheme” when they acquired a new home.

The detriment to Buyers, which impacts Sellers, is glaringly obvious. Claims that Sellers are harmed fail.

To The Plaintiff’s Legal Team, Your Complaint Is Complete Garbage.

The following counterpoints may enlighten you:

Consumers bank dollars, not percentages, so claiming damages based on percentages vs. aggregate fees paid is disturbingly misguided. Studies often cited by other Plaintiffs include markets like Singapore and Australia. Although Singapore’s average commission percentage fee is 3%, thus lower than NAR’s average of 4.94%. Studies state that the average home value in Singapore converted to USD is $1,497,034; thus, factoring in a 3% commission, the average selling fee in Singapore is $44,911.

Continuing the narrative that Consumers bank dollars, not percentages, let us explore Australia, the Plaintiff’s selected market, to corroborate excess fee assertions. The average home value in Missouri, where the case was brought, is $227,286. Consumers in Australia pay an average home price, converted to USD, of $735,104. Assuming Missouri Sellers pay 4.94% in fees, this would total $11,227, while a 2% transaction in Australia would total $14,702. Arguments factoring Plaintiff’s selected market fail. I can provide a list of a dozen international markets which are even more detrimental to excess fee allegations.

Your cherry-picking of markets and muddying the waters is impressive.

Claims of excessive fees fail.

Your economic “expert” economists Natalya Delcoure and Norm Miller compared international real estate commissions with those in the United States. They concluded: “Globally, we see much lower residential commission rates in most of the other highly industrialized nations, including the United Kingdom (UK), Hong Kong, Ireland, Singapore, Australia, and New Zealand . . . . In the UK, the [total] commission rates average less than 2%. . . . In New Zealand and South Africa, [total] commission rates average 3.14%. Singapore’s [total] commission rates also tend to run around 3%.” Moreover, In comparison, the total broker commissions (i.e., the aggregate commission paid to the seller broker and buyer broker) in the areas in which the Subject MLSs operate average between 5% and 6%, with buyer broker commissions by themselves holding steady in a range between 2.5% and 3%.“

Also, The ”expert” in the Moehrl case appears to be equally confused about the difference between actual fees and percentages. The Moehrl expert appears to be a Harvard Law Professor. I believe anyone who fails to understand the difference between the two metrics should not be teaching pre-school, much less Harvard Law.

A dictionary may not have been required reading at Ivy League Universities, so I will explain. In mathematics, a percentage is a number or ratio that represents a fraction of one hundred. Aggregate Fee means the sum of all fees payable under an Agreement during the Contract Term. Fractions and Aggregate Fees are entirely different metrics, despite your feeble attempt to conflate.

a. If a home sells for $200,000 at 4.94%, the aggregate commission paid is $9,880.

b. If a home sells for $400,000 at 4.94%, the aggregate commission paid is $19,760.

If I asked you about gas prices, you would not reply with “3% of the cost of a barrel of oil.”

Moreover, the case cites the study: See Natalya Delcoure & Norm G. Miller, International Residential Real Estate Brokerage Fees and Implications for the US Brokerage Industry, Int’l Real Estate Review (2002)

2002? Are studies from 1937 unavailable?

Claims that Plaintiff’s expert witnesses’ studies are reliable fail.

Regarding markets that attempt to corroborate that Realtors charge supra-competitive fees, there was no need to use Australia, 8,734 miles away, when there are domestic and northern hemisphere comparables. Canada has a similar fee structure to US, and iBuyers, whose goal was to reduce the role or eliminate Agents, have all reduced their fee structures to compete with the MLS.

The average NAR fee is 4.94% (historically reduced from 7%), and OpenDoor recently disclosed that they are under federal investigation regarding claims of superiority over traditional Realtors and fees imposed. OpenDoor now claims, “Pay just 5% in fees.” Moreover, they now disclose; “Beginning on September 30, 2020, for new offers, Opendoor’s service charge will be no more than 5%. Service charge is subject to change and has historically been as high as 14%.”

Offerpad reduced fees from 7.5% to 5%.

If anything, the MLS aids in placing downward pressure on fees. Also, if a Proptech startup fails to profit despite millions in investment proceeds and operating in an appreciating housing market, then THEY ARE UTTERLY UNQUALIFIED TO CLAIM REALTORS AS OVERPAID. BECOME PROFITABLE BASED ON A REDUCED FEE MODEL, AND WE CAN HAVE A CONVERSATION.

The onslaught of Wall Street-backed proptech startups who claimed their technological advantages would create profitable companies while reducing fees to Consumers has failed.

The proptech iBuyer market has seen better days.

Claims of supra-competitive price collusion fail.

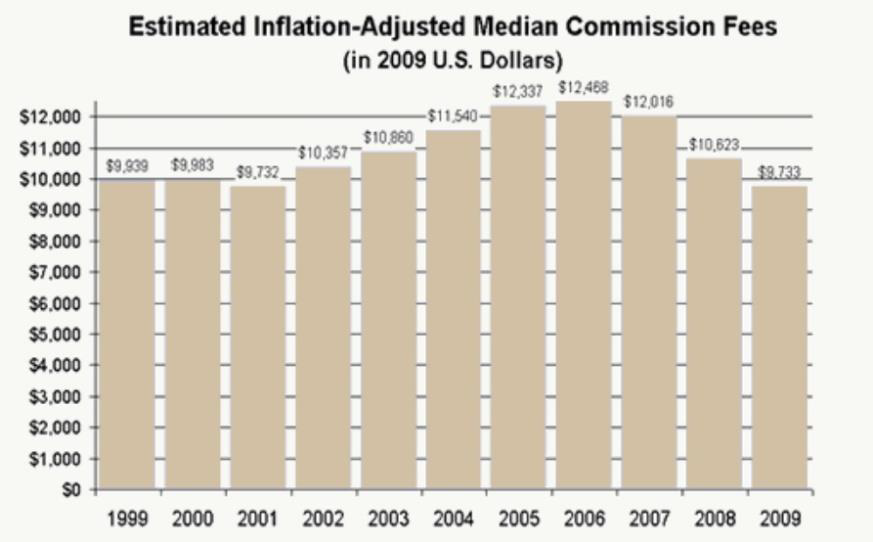

Moreover, the complaint mentions the DOJ complaint, yet the DOJ disagrees with the lawsuit’s assertion that Sellers are harmed and claims that Buyers pay the commission as it is “baked” into the price. It would be nice if opposing parties would elect a final position on this matter. Additionally, the DOJ published this report showing aggregate fees fluctuate based on market conditions, and commission fees diminished further in 2010 and 2011.

Claims that fees have stayed consistent since 2001 fail.

Regarding claims that Sellers are paying excess fees to Realtors and that Realtors are overcompensated because technological advances should reduce fees comparing industries, including “Book Stores.“

I am ignorant of the metrics related to operating a bookstore; however, IBM Watson’s legal solutions state they can reduce Attorney expenses by up to 80%. Should I assume you have reduced your firm’s fees by 80%, factoring in “technological and social changes?”

The complaint claims, “Most Buyer brokers will not show homes to their clients where the Seller is offering a lower adversary/Buyer commission, or they will give priority to showing homes with higher adversary/Buyer commission offers first.” WHILE SIMULTANEOUSLY ASSERTING that “Many home Buyers no longer search for prospective homes with the assistance of a Broker, but rather independently through online services.”

These assertions conflict: if a Buyer finds a home they want to tour online, how can an “Agent not show homes to their clients where the Seller is offering a lower adversary/Buyer commission, or they will give priority to showing homes with higher adversary/buyer commission offers first?”

Moreover, The ability of many home buyers to search for prospective homes through online services is a direct benefit of the MLS system. The MLS system syndicates listings to portals like Zillow, which do not filter properties based on commissions. Average monthly portal visits exceed 559m, yet there are only 331m US citizens. Listings are not concealed, nor is there massive steering. If a Buyer asks an Agent to view a home, and they refuse, the client will find another Agent.

Additionally, when we evaluated a non-MLS firm last year, the “disruptor” listed ~15 properties in the greater Las Vegas area. This is a performance that a single, average Agent could achieve. At that time, 5,133 active listings in the Las Vegas area were displayed via various sources. Moreover, this firm is believed to have imposed a minimum listing fee of $9,500, so Consumers would pay MORE when selling homes at ~$200,000 or less.

Should every real estate portal get to select which listings to display, and if so, how does this benefit Consumers? This would result in “steering.” The Clear Cooperation Rule ensures that Consumers have access to the vast majority of real estate listings.

Furthermore, the “steering” claim may have originated from Rex Homes; however, Rex claims they do not pay Buyer Agent commissions. Must agents work for free? Quantum Meruit states NO: “A principle used to award the reasonable value of services performed.” Buyers’ Agents are entitled to compensation.

Also, you brought a claim against Associations, MLS entities, and Brokerages, yet those parties include employees protected by the Fair Labor Standards Act (FLSA), which includes compensation requirements. They cannot be forced to work for free.

Claiming the Clear Cooperation Rule is anti-Consumer and massive steering exists fail.

Anti-Trust Claim

The MLS (and its commission framework) is the preeminent marketing tool to market Seller listings, discovery tools for Buyers, and simplify a path to homeownership for millions.

The benefit of the current structure far outweighs any detriment.

Per federal statutes, “The Sherman Act outlaws “every contract, combination, or conspiracy in restraint of trade” and any “monopolization, attempted monopolization, or conspiracy or combination to monopolize.” Long ago, the Supreme Court decided that the Sherman Act does not prohibit every restraint of trade, only those that are unreasonable.

Fees to join the MLS are often less than $500/year, so the restraint of trade claims fails.

Ask Jack Ryan from Rex Homes if failing to display properties on the MLS is favorable.

In addition, NAR is not a monolithic group. I receive up to 30 postcards per month from Agents seeking to list my home, who all compete on price and service. Hawks is a NAR member who offers 1% listing fees.

The claim, which was filed in Missouri, cites Missouri’s Antitrust Law which at first glance appears to be even more restrictive than federal statutes; however, you may have missed the section which claims Missouri is construed “in harmony” with federal law.

Furthermore, it appears the original Plaintiffs, Joshua Sitzer and Amy Winger, are no longer named Plaintiffs and are replaced by attorneys and a doctor.

Replacing Plaintiffs with others who understand the legal process is prudent considering Plaintiff Christopher Moehrl, in my view, was a compelling witness FOR the defense via his deposition.

Claims that NAR violates the Sherman and Clayton Act fail. Cherry-picking markets to file lawsuits fail.

In an absurd claim that the MLS obstructs innovation, in reality, so-called innovators join the MLS to benefit from its capabilities while deploying their proprietary features.

Redfin, which uses advanced technology and offers rebates that diminish commissions paid, received 73.1M visitors in May.

Independent Brokerage firms which do not enjoy massive, free website traffic would need to pay ~$1.36 per visitor/click on Google Ads to achieve the exact visitor count. Their MONTHLY marketing budget would require $99,461,000 in spending.

Despite Redfin’s significant advantages of sales, referral, mortgage, title, and rental service revenue streams, Redfin disclosed:

“We may not have sufficient cash flow to make the payments required by our convertible senior notes, and a failure to make payments when due may result in the entire principal amount of the convertible senior notes becoming due prior to the notes’ maturity, which may result in our bankruptcy.”

The US is headed into a recession “in the short term,” and eliminating a path to homeownership for ~20% of Buyers will immediately have a negative “direct effect on prices in the relevant market,” a key factor when evaluating anti-trust.

Claims that NAR stifles innovation fail.

Preponderance Of Evidence

For the Plaintiffs to prevail in their defective and whimsical claim, a preponderance of the evidence must be established.

Over the prior 24 months, to my knowledge, three prominent class action firms claimed the Seller was damaged, and Judge Andrea Wood agreed with this position. Conversely, three prominent class action firms claimed the Buyer was damaged as commissions are “baked” into the sale price. The DOJ supports this position.

If some of the brightest legal minds in the world cannot reach a consensus, how will a jury?

In summary, this is not an adversarial transaction, all parties have the same goal, and in my view, your unjust claims could be detrimental to millions of US citizens.

Based on the arguments outlined, in my view, this case lacks merit and should be voluntarily dismissed.

In summary, you failed.